New poll: the rise of ‘buy now, pay later’

Hello from SurveyMonkey! In this week’s newsletter, Sam is back with an exclusive followup from our research last August on the rise of ‘buy now pay later’, a payment option that allows shoppers to pay for purchases in installments over time. While marketed as a service that helps make big-ticket items more affordable, ‘buy now, pay later’ has evolved into a standard payment option for top retailers (such as Amazon, Walmart). Take a look at our new findings below on how consumers have adopted ‘buy now, pay later’ in their shopping experiences!

One in four (25%) Americans have used a ‘buy now, pay later” service in the last year

Adoption of ‘buy now, pay later’, a type of payment option which allows consumers to pay for purchases in smaller payments over a set period of time, continues to rise. One in four (25%) Americans have used the service to make a purchase within the last 12 months - up from 20% in August of last year. Usage and interest is up across all age groups, but is mostly driven by lower-income adults (making less than $100k/year).

Nearly one in five (19%) ‘buy now, pay later’ users use the service for purchases of any size

Buy now, pay later users most commonly use the service for purchases between $100 and $499, but usage is seen across all price points: more than one in three (35%) cite $100 and $499 as their minimum threshold, while one in five plan on using BNPL for purchases less than $100 (17%), or at any price point (19%). Lower-income Americans are more likely to have a lower minimum threshold, with 23% of BNPL users making less than $50,000 per year saying they use the service for purchases less than $100, compared with only 6% of those making six figures or more.

Affordability a key driver of usage of ‘buy now, pay later’ for lower-income Americans, while interest-free payments attract wealthier users

Flexibility in payment schedules is the leading driver of ‘buy now, pay later’ adoption, followed by interest- or fee-free payments (46%) and affordability (46%). Younger consumers are especially attracted to the flexibility offered by such services, while differences in reasons for usage arise among income levels. Alongside flexibility, a lack of ability to pay in full is the leading reason for usage among those making $50,000 or less. Affordability, however, is largely an afterthought for wealthier consumers, with interest- and fee-free payments as the leading driver among those making $100,000 or more annually.

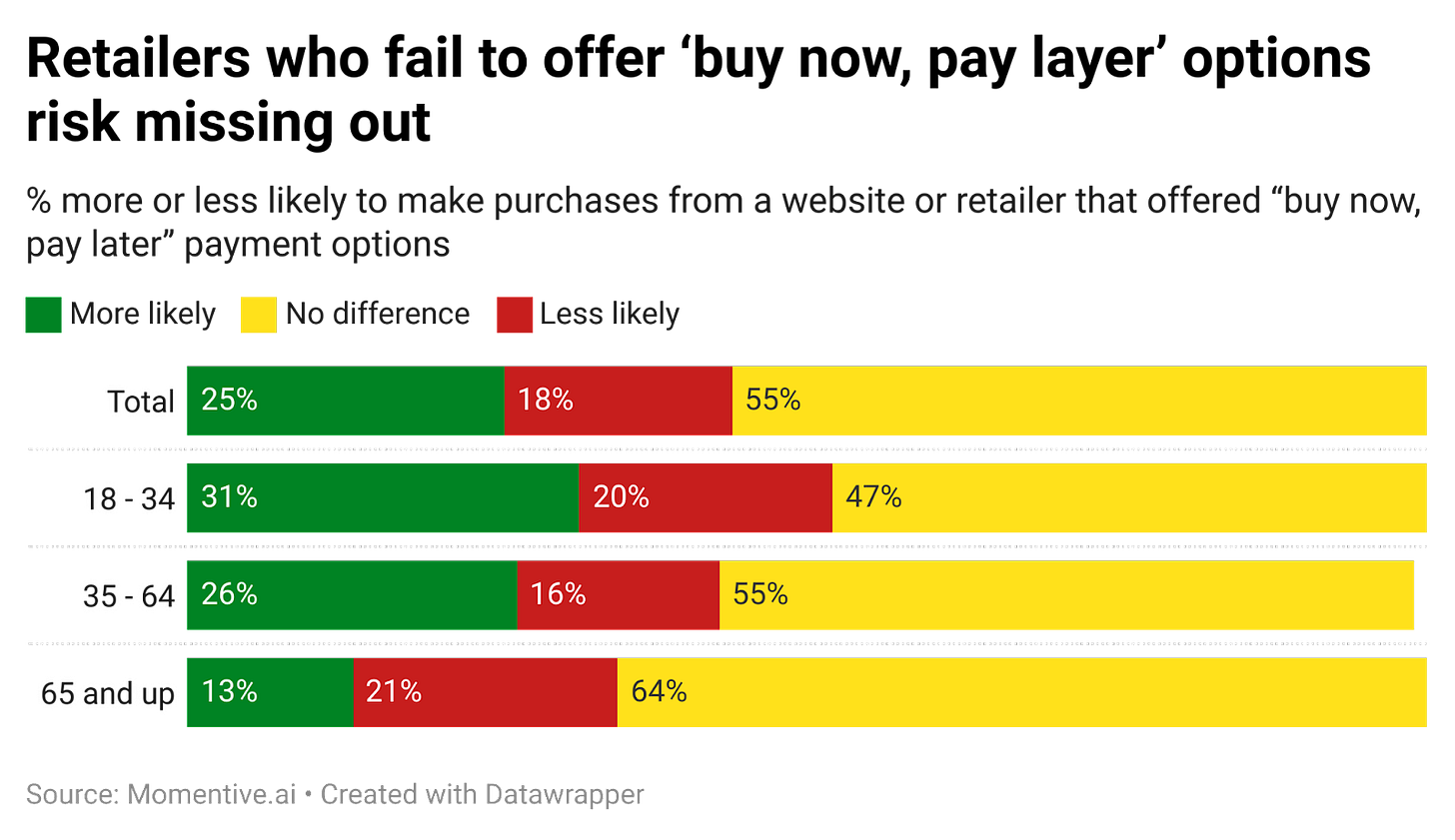

Retailers who fail to offer ‘buy now, pay layer’ options risk missing out

The proliferation of buy now, pay later services has not gone unnoticed: the majority of shoppers now expect retailers to feature it as a payment option. One in four (25%) consumers say they are more likely to shop at places that offer ‘buy now, pay later’, with demand once again largely driven by younger consumers.

That’s all for this week! Thanks as always for reading.